Two weeks of rain and powerful winds in California led to mudslides, flooding, widespread power outages, and a state of emergency declared in eight Southern California counties. Farmers are preparing to survey the damage contingent upon the ground drying out to allow field access. Citrus, almonds, avocado, and strawberry crops are expected to be impacted and, according to the USDA, have already contributed to 84% fewer truckloads of produce compared to this time last year.

There’s still plenty of time for the 2024 produce season to get back on track, but considering national produce volumes are already 17% lower than last year, the success of this year’s produce season depends heavily on how well California recovers. In contrast, Washington state produce volumes are very healthy, reporting 19% more truckloads last week than last year, while in Yuma, AZ, the Winter Salad Bowl, lettuce volumes are currently 6% higher than in 2023.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

California is typically the forerunner for the national truckload produce market, and after dropping for the sixth week, outbound reefer rates at $2.08/mile are $0.04/mile lower than in 2019. Late reporting of citrus volumes will undoubtedly improve the comparison to prior years. Still, given the similarities to last year when heavy rain also impacted produce growers at the start of the planting season, there’s every reason to think this year could be similar. In Fresno, the largest produce market in the state, linehaul rates for outbound loads were 4% lower last week at $1/71/mile, even though truckload volumes were up by 6% w/w. Fresno to Phoenix loads paid carriers an average of $1.92/mile, the lowest in 12 months and $0.46/mile lower than last year.

The one bright spot in the produce-hauling market is in Yuma, AZ, the Winter Salad Bowl, where 90% of leafy greens are grown over winter. Arizona produce volumes are 6% higher than last year, driven by iceberg lettuce volumes, 10% higher than last season, and accounting for 72% of outbound truckloads last week. Carriers were paid an average of $2.87/mile last week for loads west to Los Angeles, $0.10/mile higher than last year and the highest in 12 months.

Load to Truck Ratio (LTR)

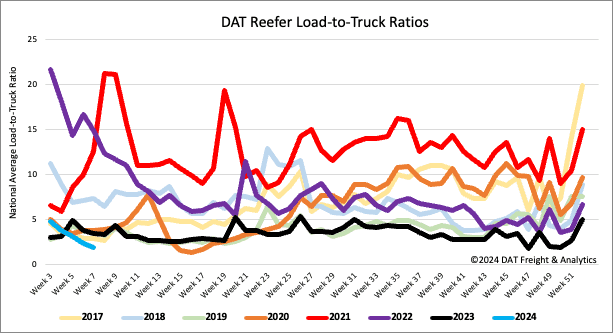

National spot market load post (LP) volumes dropped for the fourth consecutive week following last week’s 25% week-over-week (w/w) decline. LP volumes have remained at their lowest in eight years and 61% lower than last year. The volume of produce moving nationally starts in 2024 at the lowest level in ten years, contributing to lower spot market volumes last week. Carrier equipment posts were down 11%, resulting in last week’s reefer load-to-truck ratio (LTR) decreasing by 16% w/w to 1.94, the lowest in eight years.

Spot rates

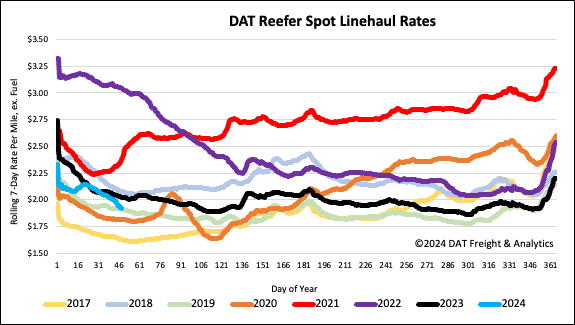

National average reefer spot rates dropped for the fourth week following last week’s $0.06/mile decrease. At $1.94/mile, reefer linehaul rates dropped below $2.00/mile for the first time since mid-December, decreasing by $0.20/mile in the last month and, compared to last year, are $0.10/mile lower.